Board: Main

Sector: Plantation

GICS: Consumer Staples/Agricultural Products

Market Value - Total:MYR1,174.4 mln

Summary: Kwantas is a fully-integrated plantation group. It has 14,678 hectares (ha) of planted oil palms in Sabah and is developing another 33,848 ha of land in Sarawak. Its downstream manufacturing operations are located in Sabah and China.

Analyst: Siti Rudziah Salikin (standard & poor)

Highlights

A series of acquisitions over the past four years have transformed Kwantas into a medium-sized plantation group with a total plantation land bank of 51,393 ha in Sabah and Sarawak.

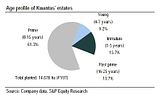

Kwantas’ planted estates (14,678 ha) in Sabah have among the highest yields in Malaysia. There are still rooms for the yield to improve as about 24.9% of the palms are still young (below the age of seven years). New plantings that will be undertaken over the next 5-6 years in Sarawak will support production growth in the longer terms.

The downstream manufacturing facilities in China, comprising bulking facilities, an oil refinery, shortening/margarine plants and oleochemical plants, are now fully operational. The full-year impact of the commissioning of oleochemical and soap noodle plants will be reflected in FY09 (Jun.) earnings. The refinery in Lahad Datu (Sabah) is currently operating at 70%-75% capacity.

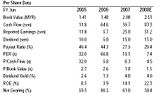

We project a 2x YoY rise in net profit for FY08 and a 5.5% YoY growth for FY09 driven by the strength of palm oil prices, higher production and increased contributions from the China’s operations.

Investment Risks

Risks to our recommendation and target price include: (i) CPO price volatility, which could affect the performance of the plantation and manufacturing divisions; and (ii) an economic slowdown in China.

Recommendation

We initiate coverage on Kwantas with a Buy recommendation and 12-month target price of MYR4.45, offering potential upside of 17.7%. We like Kwantas for the management efficiency and its fully-integrated operations (which will cushion the downside earnings risks from a weakness in palm oil prices). The stock also offers a decent dividend yield, which we expect can be sustained in view of increased cash inflows from the plantation operations.

The target price is based on 8x PER on projected FY09 earnings and includes our projected dividend of 15 sen. The assigned PER is within the range of our target PER of between 8x-10x for medium-sized plantation stocks and single-digit multiples for small- and medium-sized consumer stocks in China.

Kwantas is addressing the low share trading liquidity via a share split, which was completed in January 2008 and doubled its issued shares to 310.7 mln. Kwantas also has a sizeable reserve which can potentially be distributed to shareholders in a form of a bonus issue.

From its FY07 annual report, we note of Kwantas’ commitment towards fulfilling its corporate social responsibility through various initiatives including building homes, schools and care centers for children, organizing various events and social activities for the benefit of the community, and adopting strict policies to preserve the environment.

Background

Established in 1996, Sabah-based Kwantas has grown into a medium-sized oil palm plantation group in Malaysia (in terms of land bank) with established downstream operations in Sabah and China. A series of acquisitions over the past four years expanded Kwantas’ plantations to 51,393 hectares (ha) from 10,171 ha in FY04. Its downstream activities include palm kernel crushing, palm oil refining, shortening and oleochemical manufacturing, and provision of bulking facilities.

The group is managed by an experienced and long-serving team headed by members of the Kwan family (the founder and major shareholder), who have more than 20 years of experience in the palm oil businesses.

Corporate Structure

Upstream plantations

Kwantas has 17,545 ha of plantation land in Sabah, of which 14,678 ha are planted with oil palms. Over the past two years, Kwantas secured 33,848 ha of land in Sarawak and expects to develop about 5,000 ha per annum into oil palm plantations over the next 5-6 years. Kwantas aims to increase its plantations to about 200,000 ha through acquisitions of plantation land in Kalimantan, Indonesia. Management, however, has not provided a specific time frame for the Indonesian venture.

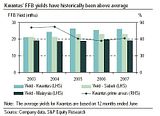

Kwantas’ estates in Sabah have among the highest fresh fruits bunches (FFB) yields in the country. Apart from Kwantas’ good agronomic practice, the lands in Sabah are generally more fertile compared to that in Peninsular Malaysia partly because the plantations are still at the first generation of plantings. Kwantas also has a sizeable percentage of planted palms (between 57% and 82% of the total planted areas in the past five years) that are at prime age of 8-15 years. The increase in prime areas in FY07 helped Kwantas to counter the general downtrend in biological yields, which occur every three to four years. While the industry experienced a drop in yields in 2007, Kwantas managed to show an improvement in its yields to 26.15 tonnes/ha (from 25.4 tonnes/ha in FY06) and a 4.6% YoY growth in FFB production. Kwantas oil extraction rates (OER) of 21.3% for FY07 was above the industry’s average of 20%.

Kwantas should be able to sustain its above average FFB yields with some rooms for improvement to support production growth in the medium-term as more young areas enter the prime age. As at end FY07, about 24.9% of the palms are below the age of seven years. None of the palms are due for replanting within the next 2-3 years.

Kwantas’ CPO production cost of about MYR700/tonne is also among the lowest in the industry. Given the rise in fertilizer and fuel prices, we expect the production cost to have risen. However, the cost for Kwantas is likely to stay below that of its peers in view of the peak production years of the palms and the above average OER, which help to lower the cost per tonne, as well as the use of its own bio-mass power plant.

At the same time, Kwantas does its own plantings (instead of contracting the works out to third parties), thus cutting its new planting expenditure to about MYR4,000/ha in the past. Material and other costs have since gone up, thus management expects to incur a higher expenditure (about MYR7,000/ha-MYR8,000/ha) on the new plantings in Sarawak.

Downstream manufacturing - Malaysia

Kwantas has two palm oil mills in Sabah with a total processing capacity of 150 tonnes of FFB per hour. The mills are currently operating at full capacity and process FFB from Kwantas’ own estates and from outside purchases. We expect the external FFB intake to be gradually reduced from 50% in FY07 as Kwantas expands the production from its own estates.

The crude palm oil (CPO) and palm kernel from the mills are mostly supplied to Kwantas’ palm oil refinery and kernel crushing plant, which is situated at Kwantas’ 14-ha edible oil complex in Lahad Datu. The plant also sources CPO and palm kernel from external parties. The complex is equipped with its own bulking facilities and two privately-owned jetties, thus assuring an efficient method of transportation. Kwantas also has its own 9.8 MW bio-mass power plant, which recycles the empty fruit bunches from the plantations and generates electricity and steam for the manufacturing and processing plants. Kwantas plans to build a second bio-mass power plant to further reduce its dependence on external power sources and mitigate the risk of rising energy prices while at the same time contribute to the conservation of the environment.

The refinery in Lahad Datu currently operates at about 70%-75% of its capacity of 2,400 tonnes per day. It produced 464,000 tonnes of refined bleached deodorised palm oil, 22,697 tonnes of palm fatty acids distillate, 92,978 tonnes of refined bleached deodorized stearin and 348,798 tonnes of refined deodorized olein in FY07. The products are catered mostly for exports to other countries such as China, India and Europe.

Downstream manufacturing - China

Kwantas started off in China in 2000 with just a sales and marketing office. It has since set up two manufacturing bases at the Guangzhou Free Trade Zone and Zhangjiagang Free Trade Zone. One of the main incentives of being in the zone is a full tax exemption in the first two years (of churning profit) and a 50% reduction of the tax rate (of 15%, currently) for the next three years.

Kwantas operates bulking facilities, a refinery (capacity: 600 tonnes of per day), a shortening and margarine plant (capacity: 144 tonnes per day) and an oleochemical plant (producing soap noodles and glycerine) in Guangzhou. The refinery and shortening plants started operations in 2005 while the oleochemical plant commenced in late 2007.

Kwantas set up similar bulking facilities in Zhangjiagang in 2004 and completed the construction of an oleochemical plant in August 2007. The plant produces soap noodles (the base ingredient for household soaps), glycerine (which is used as lubricants and in pharmaceutical and medical preparations) and oleochemical products (for the manufacturing of plastic and candles).

The plants use both palm oil-based and soybean oil-based products as feedstock. The end products are catered mainly for China’s vast market, whereby the demand for palm oil products is growing.

Earnings Outlook

Kwantas’ FY07 net profit jumped 4.4x YoY driven by the strength of palm oil prices, higher palm oil production and increased contributions from the China’s operations, which already accounted for about a third of the group’s net profit for the financial year.

We are looking at 2x YoY increase in Kwantas net profit for FY08 and a 5.5% YoY growth for FY09. Net profit for the first nine months of the financial year was MYR115.3 mln, up 2.3x YoY and already surpassed FY07 profit by a good 56.4% as the average CPO selling price jumped to MYR2,660/tonne from MYR1,800/tonne in 9MFY07. The performance going forward is expected to be better as palm oil prices have stayed strong at above MYR3,500/tonne currently.

At this stage, we still maintain our view that CPO will soften towards the latter half of 2008 to coincide with the oil palm peak production period in Malaysia and Indonesia. However, we see the potential for a sharp price correction to be limited given the strong underlying demand for food and non-food uses, and the current tight supplies of other edible oils. Adverse weather conditions, which have delayed the plantings of soybean in the US and a prolonged protest by Argentine soybean farmers, also lend a support to the CPO price.

In the event of a bigger drop in palm prices, Kwantas’ performance is expected to be cushioned by its downstream activities. The concerns would be intense competition from the bigger players in China and the government’s measures to curb inflation, which could put pressure on margins for Kwantas’ operations in China. With the commissioning of the oleochemical plants in late 2007, the facilities at both manufacturing bases are now fully operational and the full-year impact will be reflected in FY09 earnings.

Valuation

We use a PER approach to value the stock and accord a multiple of 8x to projected earnings for FY09. In arriving at the assigned PER, we take into consideration our target PER of between 8x-10x for medium-sized plantation stocks and single-digit multiples for small- and medium-sized consumer stocks in China. We add our projected dividend of 15 sen and arrive at a 12-month target price of MYR4.45.

Kwantas expects to distribute about one-third of its net profit as dividend. With the completion of the manufacturing facilities in China, the main capex requirements going forward will be directed at its new plantings in Sarawak. The bulk of the funding is expected to come from internal funds.

The recent share split, which was completed in January 2008 and doubled its issued shares to 310.7 mln, will help to address Kwantas’ low share trading liquidity. Kwantas also has a sizeable reserve, which can potentially be distributed to shareholders in a form of a bonus issue.

Recent Development

January 2008: Kwantas completed a 1-for-2 share split, which increased its share capital to 310.7 mln shares of 50 sen each from 155.3 mln shares of RM1.00 each.

July 2007: Kwantas’ subsidiary, Kwantas Plantations Sdn Bhd, subscribed to a 60% equity interest in Kwantas Pelita Plantation (Balingian) Sdn Bhd (KPPBSB ) for RM60. KPPBSB is a joint venture company established together with Pelita Holding Sdn Bhd to develop 14,416 ha of land in Mukah Division, Sibu, Sarawak into oil palm plantations. Pelita Holding is a nominee company of the Ministry of Land Development of Sarawak.

No comments:

Post a Comment