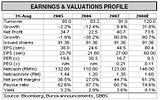

Strong growth and margins, solid financials,attractive dividend yield and undemanding valuations.

A hidden gem among plantation stocks. Although many plantations stocks rallied due to the surge in CPO prices, the share price performance of smaller planters has lagged it larger peers by 33% from their 52-week lows, and most of the PER’s of the largecap plantation stocks are now at a 50% premium to smaller plantation stocks and P/BV at 160% above. We view the huge valuation discount of the smaller planters such as Chin Teck unjustified. Chin Teck Plantation Bhd (CTPB) may be a laggard in the plantation sector but its strong earnings growth, superior margins, attractive yield, solid financials and undemanding valuations make it a hidden gem among plantation stocks.

Laggards are playing catch-up. While big caps such as IOI, KLK, and SIME had experienced earlier run-up, many of the smaller laggards offer good values and are likely to re-rate upwards in tandem with the plantation bluechips, as valuations of the former become more pricey. Indeed, some of these smaller plays such as CTPH may be more suited for conservative investors who prefer less volatility, due to two main factors: 1) lower level of foreign ownership, which makes them less susceptible to sharp sell-downs when commodity prices dip, and 2) undemanding valuations, with additional supporting factors like high asset backing or attractive dividend yields.

Corporate Profile. Founded 50 years ago by the Goh family, who also founded Tat Lee Bank in Singapore. The Goh Family is also the major shareholder of Negeri Sembilan Oil Palms Bhd (NSOP), another listed but smaller oil palm plantation company. Both companies have amongst the strongest balance sheets for Bursa Malaysia listed companies.

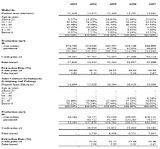

CTPH‘s principal activities are the cultivation of oil palms, processing and sale of CPO and palm kernel. Currently, CTPB’s plantation estates totaled 11,326ha and are located in Negeri Sembilan, Kelantan and Pahang. In addition, Chin Teck entered into a joint venture with Seong Thye Plantations (related company via common major shareholders), back in 1997 to undertake the development of approximately 36,000 ha of land into oil palm plantation in Sumatra, Indonesia. Other than the plantation business, the Group’s business interest includes property development (in Negeri Sembilan) and food manufacturing (in China).

Despite some non-plantation business, CTPH can be viewed as a pure plantation player as the Group does not have any downstream manufacturing operations while the plantation division contributed approximately 99% of 1QFY08’s pretax earnings. Out of its total planted area as at end-Aug 07, approximately 87% is mature, with 8% aged between 6-10 years, 14% between 11-15 years, 37% between 16-20 years and the balance above 20 years of age.

More than a decade ago, CTPB showed far-sightedness when it ventured into Indonesia when the cost of investment was much lower and it is already reaping the benefits. The plantation operation in Indonesia is carried out through 50% associate Global Formation (M) Sdn Bhd. The other 50% interest in the company is believed to be held by the Goh Family. Global Formation in turn holds a 70% interest in two plantation companies, which are developing 36,000ha of jungle land in Padang and Lumpang, Sumatra into oil palm estates. CTPB’s effective stake in the venture works out to 35% (or 12,600 ha).

About 22,000 ha of land in its Sumatra estates have been planted with the majority of these palms are still in the immature phases but the ratio has declined over the years. Out of its total planted area as at end-Aug 07, the immature trees (below 6 years) ratio has reduced from 78% in 2003 to 56.9% in 2007 whilst the 6-15 years has increased to over 43% in 2007 from 21.9% in 2003. Although earnings contributions are unlikely to be significant at this stage given the low initial FFB yields, we expect earnings to pick up significantly going forward as more of the palms reach their maturity, thus lifting FFB yields and output. In fact, the earnings contribution from Indonesia has ballooned to RM3.6m (about 15% to PBT) in 1QFY08 from RM65k in 1QFY07 and RM1.3m in 4QFY07. In the longer-term, when its Indonesian plantations are fully planted and mature, earnings contributions from Indonesia could potentially match the Group’s current earnings. Given its strong annual operating cash flow of RM40-50m, CTPB should have no problems funding its expansion program in Indonesia.

A powerful 1Q08. Chin Teck reported a RM19.4m net profit in 1QFY08 (+29% q-q), spurred by a higher average spot CPO price (+47% q-q) and increased production of CPO, coupled with higher contribution from its associates in Indonesia. Net profit margins also increased from 53.7% in 4QFY07 to 58.4% in 1QFY08 whilst netcash jumped 13% q-q to RM139.6m. As at end-Nov 07, its investment in securities, which cost RM17.7m, had a market value of RM33.7m, translating into a gain of RM16m. Meanwhile, its reserves as stood at RM368.3m, which are sufficient for the group to declare a four-for-one bonus issue if it wants to.

We expect net earnings in FY08 to grow 80.7% to RM73.5m, driven by a high CPO prices, stable FFB yields from its Malaysian plantations and the increasing contributions from its associates in Indonesia. CTPB’s expansion to Indonesia has effectively doubled the Group’s total planted area. Once its Indonesian plantations are fully planted up and mature, Group earnings could potentially double from current levels.

Promising CPO outlook. We believe the current weakness in the plantation stock presents a good opportunity to accumulate, as the fundamentals of the sector are still intact. Although CPO prices have retracted by 5.6% from all time high at RM3400/tonne on Jan 14 amid concerns of slowing global economy and potential ban of palm based biodiesel in Europe, worries on edible oil supply shortfalls as more acreage will be diverted to corn and wheat plantations to produce ethanol due to better returns, and overall robust demand from China and India render good supports for the CPO prices. We believe that the CPO price upcycle will be extended beyond the traditional 2–3 years on production shortfalls and investors should start rebuilding position in the sector should prices fall further.

With the expected EU biodiesel ban not materializing, a large part of uncertainty surrounding the sector has been removed. In any case, we think the fear is unwarranted given the small proportion of palm oil being used for biodiesel. Meanwhile, the switch to TFA-free (trans-fat acids free) food oils is also fast gathering pace in the US, which has continued to contribute to the increase in Malaysian palm oil exports to US.

Indonesian landbank provides impetus for growth. We believe its 2 Indonesian JVs, which involves the development of an aggregate area of 36,000 ha of land (22,000 ha planted, 10,000 ha matured) where the group has a 35% effective stake would contribute significantly to group earnings in the coming years. Our earnings forecasts assume that its Indonesian ventures would constitute 15-20% of earnings over the next two years.

Surprises from the 50th anniversary celebration? CTPB’s net dividend payout has ranged between 35% and 80% for the past five years. Given its net cash position of RM139m and strong balance sheet coupled with anticipated robust growth in FY08 earnings, we project CTHB to deliver higher dividend per share of 60sen in FY08, giving an attractive yield of 8.1%. We believe higher dividend payout in FY08 is possible, considering the management operates an ‘old school’ style and focuses on growing earnings and distributing profits back to shareholders as well as in conjunction with Chin Teck’s 50th anniversary as a listed entity. On its 40th anniversary, it declared a special dividend of 20 sen a share to reward shareholders.

Further re-rating is likely. While the overall plantation sector is up almost 80% from 52-week low, CTPB has significantly lagged, up just 46%. Valuations are cheap at 9.3x 2008 PER (ex-cash 7.6x). We value the stock at RM9.00, implies a 2008 PER of 11.2x (trades at 40% discount to industry average), which we believe adequately compensates for the stocks illiquidity and market capitalization, despite offering strong earnings growth, superior margins, attractive yield, solid financials and good leverage to CPO prices.

filed: chintek040208.pdf

我不觉得chintek是个高economy of scale的公司,什么是superior margins?Goh Eng Chew家族除了掌舵NSOP还有什么"both good"的公司?去年的joint venture现在进展怎样?为什么印尼的JV每年达不到总投资额的10%?为什么JV和associate投入了两亿,几年都没有dividend income?

拿人手软,吃人嘴短,当然要说好话。

chintek是庄股,在熊市可抗跌,这是好处。

No comments:

Post a Comment