gan-huey-ling@ambg.com.my

Investment Highlights

We affirm our Overweight stance on the plantation sector with unchanged CPO price assumption of RM3,500/tonne for 2008 and 2009. Our bullish conviction is premised on the good margins enjoyed by the upstream and downstream plantation segments and earnings convergence from CPO production and acquisitive growth. In this report, we highlight the investment and operational attributes of the four largest plantation companies under our coverage i.e. IOI Corporation, Sime Darby, Wilmar International and Indofood Agri-Resources. These four companies collectively account for 15% of the world’s CPO production.

In the upstream segment, IOI is the undisputed leader. This is because of its sterling FFB yields of 26 tonnes/ha to 28 tonnes/ha and efficient operating costs, which are consistently below the industry average. However, in the longer-term we believe that this may not be sustainable as IOI’s prime trees would start to age while contribution from the Indonesian estates would take time to be significant. Instead, we believe that in three to five years’ time, Wilmar and Indofood would demonstrate the strongest rate of production growth due to the young age profile of their oil palm trees. We estimate the CAGR of FFB output of Wilmar and Indofood from FY08F to FY11F at 7% respectively versus IOI’s 2% and Sime’s 3%.

In the downstream segment of refining and specialty fats, margins have expanded because of good market timing, strengthening demand and improving selling prices. Going forward, we expect demand and refining margins to remain positive although growing at a slower rate. The growth is driven by supply disruptions caused by unfavourable weather and organic factors such as increasing population and urbanisation. Wilmar would be the main beneficiary due to its large economies of scale in Malaysia, Indonesia and China and good track record in reading the commodity markets.

In the specialty fats segment, we believe that IOI is well-placed to take advantage of growth opportunities. Demand and operating margins are expected to improve underpinned by structural changes in USA. Increasingly, palm oil-based products are gaining acceptance in the country as more cities e.g. New York ban the use of trans-fats in restaurants and more consumers are aware of healthier alternatives. Although food inflation is a concern, we reckon that palm oil would be a beneficiary as food companies switch to a cheaper vegetable oil. On average, CPO is 17% - 19% cheaper than soybean oil.

Wilmar and Indofood are the most aggressive in their landbanking policies. Both companies acquired other players to grow their landbank. We believe that Wilmar’s upstream expansion is part of its broader strategy to build up a global integrated business model. In the longer-term, we believe that this business model is more sustainable as earnings are smoother and less vulnerable to the volatilities of the commodities price cycle. Although IOI has not been as aggressive as Wilmar and Indofood in the upstream segment, the group has been slowly building up its presence in the food-based industries in USA and Europe through Loders Croklaan. Recently, IOI announced plans to construct new plants in USA and Europe, costing about US$200m in total.

Among the four companies, IOI was the most aggressive in capital management. Over the past years, the group has increased dividend payments and carried out a capital repayment, share split, share buy-backs and cancellation of shares. Going forward, however we believe that there is less room for capital management as the group conserves cash for expansion plans. We reckon that Sime Darby has the most attractive dividend policy as the group returns its cash back, mainly for the benefit of its largest shareholder, Permodalan Nasional Bhd.

Valuation-wise, IOI is trading at FY09F PE of 19.1x, which is mid-way between its seven-year PE band of 7x to 27x. Wilmar’s FY09F PE of 18.5x is close to IOI’s valuation. Sime Darby and Indofood are trading at lower FY09F PEs of 12.3x and 10.2x respectively. As can be seen from the valuations and the companies’ strategy, there is a premium attached to IOI’s and Wilmar’s global exposure and integrated business model. We believe that this premium is justified as being integrated allows the plantation companies to be more efficient i.e. they can derive cost savings from almost every segment of the plantation value chain. Hence, we maintain Buy on IOI and Wilmar despite their higher PE valuations. We also like Sime Darby and Indofood for other reasons. We reckon that coming from a low base, Sime has the most potential to improve. Similarly for Indofood. As PP London Sumatra is not as efficient as Indofood, we believe that there is room for growth if Indofood is able to reduce LonSum’s costs and reap cost savings from the acquisition.

COMPARISONS BETWEEN THE BIG FOUR

In this report, we make comparisons between the four major plantation companies under our coverage, i.e. IOI Corporation, Sime Darby, Wilmar International Ltd and Indofood Agri-Resources.

We think that it would be interesting to compare the operations of these companies as collectively, they account for 15% of the world’s CPO output.

We divide the report into the following sections: -

1. Comparisons on upstream activities including analysis of hedging policies and age profile of oil palm trees;

2. Comparisons on downstream activities like refining and specialty fats;

3. Comparisons on corporate strategy;

4. Comparisons on capital management policy;

5. Comparisons on return on equity;

6. Comparisons on market reach or exposure; and

7. Comparisons on how integrated each company is.

In summary, we conclude the following:-

1. IOI’s competitive strength lies in the upstream palm oil business. The group is the undisputed leader as its operating costs are among the lowest in the region and its FFB yields, the highest.

2. Wilmar is the strongest among the four companies in the downstream segment of refining. The group’s refining margin is higher than IOI due to its large economies of scale and superb reading of the commodity markets.

3. Wilmar is also the most global player among the four companies. Wilmar’s market exposure is wide, reaching almost every continent on earth except for North and South America. In addition, Wilmar has the largest exposure to China, which is one of the fastest growing economies in the world.

4. Sime Darby is expected to have the most attractive dividend payouts among the four companies. The group’s historical payout policy has never been less than 40% of net profit and going forward, we expect this to increase to 50% for the benefit of its largest shareholder, Permodalan Nasional Bhd.

5. However, overall, IOI is the most active in capital management. Over the past few years, IOI has increased its dividends, carried out a capital repayment and share split and bought back and cancelled its shares.

6. Among the four companies, IOI is the most efficient in using its capital. The group’s return on equity is the highest, at 21.5% for FY07 and 25.7% estimated for FY08F. A close second is Indofood Agri-Resources, which is seeing a surge in profitability due to the acquisition of PP London Sumatra (“LonSum”).

DIFFERENT COMPANIES, DIFFERENT REASONS TO BUY

Our conclusions reinforce our Buy recommendations on each of the plantation companies.

We like IOI for its efficient upstream plantation business and exposure to the developed markets of USA and Europe in the specialty fats segment.

Our Buy on Wilmar is premised on its global exposure to the developing markets of China, India and Russia. Wilmar also has large economies of scale, which improves cost efficiencies.

We also recommend to Buy Sime Darby as it has the highest upside potential among the four companies. As Sime’s operating costs/tonne are inefficient, we believe that there is potential for operating costs to come down if the group manages to extract cost savings and synergistic benefits from the acquisitions of companies like Golden Hope Plantations Bhd and Kumpulan Guthrie Bhd.

Indofood Agri-Resources is a Buy for its margin-enhancing acquisition of LonSum and dominant market share in the cooking oil business in Indonesia.

SHORT UPDATE ON CPO PRICES: CPO PRICE ASSUMPTION OF RM3,500/TONNE MAINTAINED

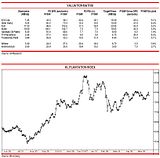

Our positive views on CPO prices remain intact for this year. As such, we maintain our CPO price assumption of RM3,500/tonne for 2008. Based on MPOB statistics, average monthly CPO price from January to May was RM3,502/tonne. As at 17 June, 3-month futures price was RM3,645/tonne.

Looking forward to 2009, it is difficult to predict the direction of CPO prices. Although previous USDA forecasts point to expanding soybean production in 2008/09, it is likely that these figures would have to be revised following the effects of the Midwest floods. Hence, for now we are leaving our 2009 CPO price assumption of RM3,500/tonne unchanged pending more clarity on the supply/demand numbers for next year.

USDA will be releasing a follow-up report in July or August after the release of its crop acreage report on 30 June. As the crop acreage report is only based on conditions and surveys taken in the first two weeks of June, the follow-up report will be released to take into account damages from the Midwest floods.

University researchers quoted in a Chicago Board of Trade report, estimated agricultural losses in Iowa at US$2.7bn. Out of the US$2.7bn, about US$2.6bn represented losses of grain crops like corn or soybeans. The researchers added that about 15% to 20% of acreage were completely damaged due to the floods. According to USDA, Iowa was expected to plant 13.2m acres of corn and 9.8m acres of soybean this season.

Corn has an impact on CPO prices as the shortage of corn would increase demand for soybean. Higher soybean prices translate into rising CPO prices.

COMPARISONS ON UPSTREAM ACTIVITIES

In the upstream segment, we compare the four plantation companies in terms of their hedging policies, age profile of the trees, operating costs, exposure to Indonesia, landbank expansion policy and Roundtable on Sustainable Palm Oil (“RSPO”) plantings.

1. Hedging policies

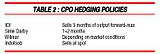

IOI’s current policy is to sell three months forward while Wilmar’s policy varies depending on the current trend of CPO prices (please refer to Table 2).

Indofood’s policy is to sell at spot prices. Its subsidiary, LonSum used to sell forward but stopped recently due to difficulties in calculating the export tax. The export tax in Indonesia is based on CPO prices in the month of delivery.

Sime Darby’s hedging policy is 1+2 months i.e. the group sells all of the CPO output in the first month of production at spot prices. In the second month, Sime would sell forward 80% of the CPO production while in the third month, the group would sell forward 50% of the output.

We understand from management that under this policy, essentially most of the group’s CPO output are sold at spot prices.

Among the four companies, we find that Wilmar reads the CPO market, the best. Although the group does not disclose the CPO prices on which it sold forward, from the group’s selling policies revealed during conference calls and discussions with management, we find that Wilmar is quite astute in reading the market. For instance, in late-2007, the group accumulated inventory and held back sales of CPO as it believed that CPO prices would reach as high as RM3,500/tonne.

Subsequently, early this year, CPO prices penetrated the RM4,000/tonne level and the group disclosed in its conference call in February, that it was cautious on CPO prices. Wilmar also said at that time that it had sold forward more than one-half of its FY08F CPO production. After that, CPO prices retraced to a low of RM3,056/tonne in April before rebounding back to its current levels of RM3,500/tonne to RM3,700/tonne.

At the conference call in May, Wilmar sounded more optimistic on CPO prices compared to the start of the year. The group believes that escalating crude oil prices and European Union’s and American biofuel policies would continue to support CPO prices.

2. Age profile of oil palm trees

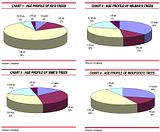

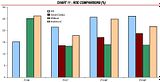

In the short-term, the age profile of IOI’s oil palm trees is the most attractive among the four plantation companies. About 74% of the group’s trees were in the prime stage of seven to 14 years as at end-June 2007 (please refer to Chart 1). This coupled with good estate management practices are reflected in the group’s sterling FFB yields of 26 tonnes/ha to 28 tonnes/ha in the past three years.

The company with the second most attractive age profile is Indofood. Approximately 48% of the group’s trees (including LonSum) are between seven to 20 years (please refer to Chart 4). Like IOI, Indofood’s FFB yields were also impressive in the past. However, going forward, we do not see exponential growth in group FFB yields as LonSum is not as efficient as Indofood.

In the longer-term however, a higher proportion of trees in the young years bode well for plantation companies as these trees would enter the prime stages, replacing the prime trees, which would then be ageing.

In this respect, we see Wilmar as having the most attractive age profile as approximately 36% of its trees were between one to three years as at end-December 2007 (please refer to Chart 2).

About 63% of Wilmar’s 573,405 ha of landbank were still unplanted as at 1QFY08 and the group’s target is to develop 35,000 ha - 40,000 ha of landbank every year (please refer to Table 4).

We believe that in three to five years’ time, Wilmar should start to enjoy incremental growth in FFB production as more trees enter the prime ages of seven to 14 years.

As for IOI, its Indonesian landbank of 52,704 ha (24% of total landbank) should alleviate the problem of not having any young trees. The group plans to develop about 15,000 ha of landbank every year (please refer to Table 4). New plantings are expected to start in FY09F and contribution should start coming in FY12F.

Among the four plantation companies, Sime Darby has the most balanced age profile of oil palm trees. Approximately 14% of its trees are below five years old while 33% and 32% of the trees are in the age bracket of five to nine years and 10-14 years respectively (please refer to Chart 3).

Interestingly, new plantings have been below expectations this year due to various reasons. For instance, Wilmar’s new plantings slowed due to implementation of the Roundtable Sustainable Palm Oil (“RSPO”) guidelines while Indofood planted less because of heavy rainfall. Nevertheless, we expect plantation development expenditure to recover in the following year as each plantation company strives to improve the age profile of its trees and increase future CPO production.

3. Operating costs

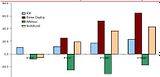

Thanks to economies of scale from the group’s high FFB yields and well-managed oil palm estates, IOI’s operating costs are consistently among the lowest in the industry (please refer to Table 3).

Among the four plantation companies, IOI’s operating costs was US$256/tonne in FY07 versus Indofood’s US$283/tonne, Wilmar’s US$332/tonne and Sime Darby’s US$304/tonne. Wilmar’s operating costs are high compared to IOI and Indofood because of its young trees.

Going forward, although operating costs are expected to rise due to fertiliser and transport costs, on a per tonne basis we believe that IOI would retain its status as a lowcost producer. A contributing factor to IOI’s efficiency is management’s hands-on approach. Tan Sri Lee Shin Cheng is known to personally visit and inspect some of the group’s oil palm estates in Malaysia.

We expect Indofood’s operating costs/tonne to rise this year as LonSum is not as efficient as Indofood. To reduce LonSum’s operating costs, Indofood has proposed measures like using in-house vehicles to transport FFB to mills instead of relying on external contractors.

Indofood would also increase the size of LonSum’s plantation estates as currently, the high-cost Plasma estates owned by the smallholders are a substantial 19% of total planted landbank. Indofood would also try to bring down overhead costs like headquarters and corporate expenses.

As mentioned earlier, Sime Darby has the greatest potential among the four plantation companies to reduce cost inefficiencies. Sime Darby’s planted landbank of 522,197 ha are large enough to generate the kind of economies of scale needed to decrease operating costs/tonne. To do this, Sime plans to increase its FFB yields and oil extraction rates. Also, nonessential operating costs like overhead would be lowered.

Going forward, as mentioned earlier, we expect operating costs for the plantation sector to rise on the back of higher fertiliser and transportation costs. Fertiliser costs have gone up by 70%-80% since last year due to escalating crude oil prices.

As such, if plantation companies did not lock-in their fertiliser costs late last year or early this year, they would be experiencing significantly higher costs. We understand that the increase in fertiliser costs would cause operating costs to be higher by RM100/tonne to RM150/tonne.

For IOI, the group would be locking-in its fertiliser supply for FY09F either this month or next. For FY09F, fertiliser costs are expected to range between RM1,600/ha to RM1,800/ ha while for FY08F, fertiliser costs were between RM1,100/ ha to RM1,200/ha. In FY07, fertiliser costs were a mere RM1,000/ha. Fertiliser accounts for almost 50% of total production costs now compared to only 30% a few years back.

4. Exposure to Indonesia

In this report, we also make comparisons in respect of each company’s exposure to Indonesia as the latter is now the largest producer of palm oil in the world. Indonesia is also the biggest exporter of palm oil to India.

Although cost-wise, Indonesia is nearly the same as Malaysia or in some cases, even higher because of hidden expenses and poorer infrastructure, Indonesia is still an attractive country for palm oil cultivation. This is because of its volcanic soil and better fruit pollination, which gives higher oil extraction rates.

Also, there is an abundance of land in Indonesia compared to scarcity in Malaysia. Additionally, Indonesia is a more familiar and proven planting ground compared to the likes of Papua New Guinea as there are quite a few Malaysian plantation companies, which are doing well in Indonesia. These include Kuala Lumpur Kepong Bhd (“KLK”) and PPB Oil Palms, which is now under Wilmar. Indonesia accounts for almost one-third of KLK’s plantation turnover.

Among the companies under our coverage, Indofood has the largest exposure to Indonesia. All of the group’s landbank or approximately 406,519 ha are located in Indonesia (please refer to Table 5). A close second is Wilmar, which has approximately 493,393 ha or 86% of its landbank located in Indonesia. Due to the acquisition of PPB Oil Palms in 2006, Wilmar also has about 80,014 ha of landbank in East Malaysia.

Approximately 36% or about 195,156 ha of Sime Darby’s landbank are in Indonesia while IOI, which is the new kid on the block in Indonesia, has about 52,704 ha. In terms of earnings, we reckon that Indonesia accounts for roughly 30% of Sime Darby’s plantation EBIT. Indonesia would only start contributing to IOI’s earnings from FY12F onwards.

5. Landbank expansion policy

Among the four plantation companies, we find that Wilmar and Indofood’s landbank expansion policies are the most aggressive. Both companies expanded the size of their plantation landbank by acquisitions. Interestingly, the timing of the acquisitions were good as they took place before CPO prices surged past the RM3,000/tonne level.

Although Sime Darby is also the result of mergers and acquisitions of a few Malaysian plantation companies, the intention of the consolidation was to create a mega size plantation company and not because each of the acquired plantation company wanted to merge.

IOI is the most conservative among the four plantation companies in its landbank expansion policy. The group finally ventured into Indonesia last year. This is after saying many times that it would not because of the country’s political risk.

Also, IOI acquired a small 9,040 ha of landbank in Sarawak last year as a platform for the group to expand further in the state. However, the group recently rescinded the proposed acquisition of 44,350 ha of land in Sarawak from a few private companies due to non-completion of certain terms and conditions.

Going forward, we believe that the cost of landbank acquisition would continue to rise. Among the four plantation companies, we reckon that IOI would be the one continuing to expand its landbank. The landbank size of the other three plantation companies are huge enough to keep the respective companies busy for the next five to ten years. As an indication of land prices, IOI’s acquisition of its Indonesian landbank last year was at US$421/ha. Currently, we understand that the market price for greenfield landbank in the country is about US$600/ha or 43% higher than IOI’s acquisition price.

6. RSPO plantings

Amongst others, RSPO guidelines ensure that palm oil cultivation are environmentally friendly. The RSPO guidelines are based on eight principles, which include commitment to transparency, environmental responsibility, conservation of natural resources and biodiversity and responsible development of new plantings (please refer to Table 6).

The guidelines are increasingly important in light of protests and complaints from the environmental organisations in Europe. The complaints are mainly in respect of the destruction of animal habitats and use of fires to clear up forests for palm oil cultivation.

Other motivation factors to comply with RSPO guidelines include the fact that some customers e.g. Unilever would only buy certified palm oil-based products. Unilever said it would start buying certified palm oil by 2015. The silver lining is that RSPO-certified palm oil could command premium pricing as high as 10%. The higher selling price would help offset higher costs resulting from the compliance and certification of RSPO.

RSPO guidelines include implementation of a proper water management system and a ban on use of fire on peat soil (please refer to Table 5). Some of the guidelines such as non-usage of fire to open up plantation areas are already practised by plantation companies in Malaysia and Indonesia.

Presently, two bodies are allowed to provide RSPO certification. These are SGS Malaysia and Control Union. Another company, Sirim QAS is still waiting for approval from the RSPO Executive Board. The four plantation companies are currently following RSPO guidelines for their new plantings. These include IOI’s, Wilmar’s and Indofood’s new plantings in Indonesia. Some of Wilmar’s plantings in East Malaysia would also be following RSPO guidelines.

(table 6)

----------------------------------------

Criteria

Efficiency of energy use and use of renewable energy is maximised

Indicators

Monitoring of renewable energy use per tonne of CPO or palm product in the mill.

Monitoring of direct fossil fuel use per tonne of CPO of FFB where grower has no mill.

Guidance

Growers and mills should assess the direct energy use of their operations, including fuel and electricity and energy efficiency of their operations. This should include estimation of fuel use by contractors including all transport and machinery operations.

The feasibility of collecting and using biogas should be studied if possible.

----------------------------------------

Criteria

No new plantings are established on local people’s land without their consent, dealt with through a documented system that enables indigenous people and local communities to express their views through their own representative institutions

Guidance

Where new plantings are considered to be acceptable, management plans and operations should maintain sacred sites. Agreements with indigenous people and local communities should be made without coercion or undue influence.

----------------------------------------

Criteria

Use of fire in the preparation of new plantings is avoided other than in specific situations as identified in ASEAN guidelines or other regional best practice.

Indicators

No evidence of land preparation by burning

Documented assessment where fire has been used for preparing land for planting Evidence of approval of controlled burning as specified in ASEAN guidelines or best practice.

Guidance

Fire should be used only where an assessment has demonstated that it is the most effective and least environmentally damaging option for minimising the risk of severe pest and disease outbreaks and with evidence that fire-use is carefully controlled

----------------------------------------

(end of table 6)

Among the four companies, Wilmar was the only one that faced complaints in respect of its plantation activities in Indonesia. We believe that this could be due to the group’s large presence in Indonesia, which invites heavy scrutiny from the NGOs.

Some of the complaints against Wilmar related to the local communities’ rights on land clearing, poor quality of Wilmar’s Environmental Impact Assessment (“EIA”) reports, conversion of forests without conducting High Conservation Value Forest (“HCVF”) assessments and open fire burning.

In response to these complaints, Wilmar has said that it would observe all legal and statutory requirements for land development and pay special attention to the potential presence of HCVF in the future.

In addition, the group would adopt a precautionary approach by conducting EIAs and a full HCVF Assessment and Social Impact Assessment before commencing any land development in the future. As for open fire burning, Wilmar said that it enforces a strict zero burning policy in all of its plantation operations.

COMPARISONS ON DOWNSTREAM ACTIVITIES

In summary, we find that Wilmar is the leader in the refining segment of the downstream business. In our view, IOI is best in the oleochemicals and specialty fats sub-segments.

Although Wilmar is larger than IOI in the specialty fats segment, we prefer IOI as we see good growth in USA and Europe. In addition, we believe that pricing in the American and European markets would be more stable and less competitive than the Chinese market.

1. Refining segment

Wilmar is the undisputed leader in the refining business. With 9.6m tonnes of palm oil refining capacity in Indonesia and Malaysia and 18.7m tonnes of oilseeds crushing and refining capacity in China (please refer to Table 7), the group is the largest vegetable oil processor in Asia.

Wilmar’s strength not only lies in the large economies of scale, which helps maintain costs at an efficient level but also in the group’s knowledge of the commodity markets. This is because Wilmar is directly involved in two of the largest vegetable oil products in the world i.e. palm oil and soybean. Wilmar buys soybean from Brazil for crushing in China.

TABLE 7 : DOWNSTREAM MANUFACTURING CAPACITIES

In addition, as one of Wilmar’s major shareholders, USbased Archer Daniels Midlands Ltd is one of the largest vegetable oil producer in the world, Wilmar has the advantage of securing market intelligence from Archer Daniels on the direction of vegetable oil prices in USA and Europe. All these give Wilmar, an edge in reading the commodity markets and timing its purchases of vegetable oils well.

In recent times when CPO and soybean prices have been rising, Wilmar’s refining margins have expanded due to improving demand and well-timed purchases of feedstock. Even when vegetable oil prices were in the doldrums before 2H2005, Wilmar was still in the black in contrast to some refiners in Malaysia, who were bleeding.

Among the four plantation companies, Wilmar’s competitors are Indofood and IOI. Indofood has 3.6m tonnes of refining capacity while IOI’s refining capacity is about 3m tonnes. However, as the bulk of Indofood’s refined palm oil are used internally to manufacture cooking oil in Indonesia, we consider IOI to be a closer competitor to Wilmar.

Between IOI and Wilmar, Wilmar’s palm oil refining margin is higher. Although pre-tax and EBIT margins are not directly comparable, they give an idea on how efficient each company is.

In 1QFY08, the pre-tax margin of Wilmar’s merchandising and processing division (mainly palm oil refining) was US$27/tonne or 78% YoY higher. In comparison, we understand that the EBIT margins of IOI’s refining division are US$20/tonne in Malaysia and Euro20/tonne in Rotterdam.

However, in terms of improvement, IOI’s refining margin showed a larger expansion compared to Wilmar. EBIT margin of IOI’s refining division in Malaysia jumped from a mere US$5/tonne a year ago to US$20/tonne currently. In Rotterdam, IOI’s refining margin remained stagnant at Euro20/tonne.

For the Malaysian refining industry as a whole, palm oil refining margin has been improving not only because of rising demand but also due to consolidation in the industry. Since Wilmar acquired the refining assets of PPB Group in 2007, competition has declined and this has helped to improve refining margin.

Apart from palm oil refining, Wilmar also crushes and refines soybean in China as mentioned earlier. The pre-tax margin of the oilseeds and grains division was US$40/ tonne (ex-forex gains) in 1QFY08 compared to US$4/ tonne in 1QFY07.

Going forward, we expect refining margin to be positive, although growing at a slower rate, underpinned by expanding demand. We believe that Wilmar would continue to be the leader in the refining segment on the back of its size and market knowledge.

2. Cooking oil

Comparisons are made between Indofood and Wilmar as only these two companies manufacture cooking oil. Although Sime Darby also has a cooking oil division, it is too small for comparison’s sake. Sime Darby’s cooking oil products in Malaysia are Golden Joma and Delico.

In general, the cooking oil business is expected to face challenging times due to rising vegetable oil prices. In Indonesia, Indofood has not faced any problems raising selling prices yet while in China, margins are expected to decline as companies have to seek approval from authorities to increase selling prices.

Indofood is one of the largest cooking oil manufacturers in Indonesia. The group has different cooking oil products for different market segments. Indofood’s market share in the Indonesian branded cooking oil industry was 42% in 2007. Wilmar’s market share was about 19.5% in the same segment. Wilmar has the second largest market share in the cooking oil industry in Indonesia after Indofood.

Some of Indofood’s cooking oil products include Bimoli Spesial for the high-end market, Bimoli for the middleincome consumers and Delima for the low-end market.

Wilmar’s cooking oil products in Indonesia are Sania and Fortune, targeted at the middle-income to high-end market. Indofood’s large market share and economies of scale in the cooking oil industry in Indonesia allows it to be the leader in pricing. The ability to increase selling prices is important in the wake of rising CPO costs.

In 1QFY08, Indofood raised the average selling price of its cooking oil products in Indonesia by 57% YoY. Surprisingly, demand did not weaken as sales volume rose 20% YoY. Due to the higher selling prices, operating profit margin of Indofood’s cooking oil division expanded from 1.5% in 1QFY07 and 1.9% in 4QFY07 to 5% in 1QFY08.

Some of Indofood’s cooking oil products include Bimoli Spesial for the high-end market, Bimoli for the middleincome consumers and Delima for the low-end market.

Wilmar’s cooking oil products in Indonesia are Sania and Fortune, targeted at the middle-income to high-end market. Indofood’s large market share and economies of scale in the cooking oil industry in Indonesia allows it to be the leader in pricing. The ability to increase selling prices is important in the wake of rising CPO costs.

In 1QFY08, Indofood raised the average selling price of its cooking oil products in Indonesia by 57% YoY. Surprisingly, demand did not weaken as sales volume rose 20% YoY. Due to the higher selling prices, operating profit margin of Indofood’s cooking oil division expanded from 1.5% in 1QFY07 and 1.9% in 4QFY07 to 5% in 1QFY08.

Furthermore, we understand that consumers have not shifted from branded to non-branded cooking oil products. In May, Indofood raised the selling prices of its products by another 3% to 10% (from April’s selling prices).

Although Wilmar is not as dominant as Indofood in the cooking oil business in Indonesia, Wilmar is big in China. The group’s market share is between 43%-50% in the consumer packs segment in China. In addition, Wilmar’s Arawana cooking oil is the official cooking oil in the coming Beijing Olympics. The group’s cooking oil is mainly made from soybean.

Wilmar’s competitive advantage lies in its wide distribution and marketing network in China. The acquisition of PPB Group’s assets have been complementary and synergistic as they allow the enlarged group to have a presence in both the inland and coastal cities.

Interestingly, Indonesia is a more liberal country compared to China in the cooking oil business. In Indonesia, there are no ceiling prices on cooking oil products and producers do not need to seek approval from authorities to increase selling prices of the branded products. In contrast, in China to curb inflation, authorities have to approve any increase in selling prices of food products.

Due to this, margins of the cooking oil business in China are not expected to be as lucrative as Indonesia. In 1QFY08, pre-tax margin of Wilmar’s consumer products division fell from US$20/tonne in 1QFY07 and US$65/ tonne in 4QFY07 to US$18/tonne.

A silver lining is that Wilmar has already received approval from the Chinese authorities for a 10% price increase. However, the group has not implemented the price increase yet as they would like to keep it for future use in case vegetable oil prices start to surge irrationally again.

For FY08F, we forecast the pre-tax margin of Wilmar’s consumer products division to fall from US$59/tonne in FY07 to US$20/tonne in FY08F. We have also imputed a 10% increase in average selling price of the division.

3. Oleochemicals

We believe that IOI is better than the other three companies in the field of oleochemicals. Although Wilmar has exposure to the oleochemical market in China, we prefer IOI as the group’s higher-margin customer base in USA, Japan and Europe means that the customers are more quality conscious and less likely to switch to other products just because of price increases.

Like cooking oil, the oleochemical industry is envisaged to face tough times due to high feedstock costs. Prices of raw materials like refined palm stearin and palm kernel oil (“PKO”) are forecast to rise in line with the uptrend in CPO prices. Apart from this, expanding oleochemical production capacity in the region have also resulted in an increase in demand for the raw materials, pushing up prices of PKO and refined palm stearin.

Although selling prices of oleochemicals are expected to go up due to high crude oil prices, this would not be enough to compensate for rising feedstock costs.

IOI exports mainly to USA and Europe. In addition, IOI also has long-term contracts with Kao Corporation of Japan. IOI’s preferred customer base are the pharmaceutical companies as their demand would remain resilient despite an increase in selling prices.

Furthermore, barriers to entry into the pharmaceutical industry are high. It is not easy for new oleochemical companies to supply to pharmaceutical companies as they would need to have a proven and established track record first.

IOI’s competitive advantage also lies in the fact that its machineries can use both PKO and refined palm stearin as feedstock to produce fatty acids. This is useful as the group can switch to PKO when prices of refined palm stearin surge and vice versa. In contrast, oleochemical companies, which have been using refined palm stearin as feedstock only, would not be able to switch to PKO.

Due to IOI’s competitive advantages, it is not surprising that despite the rising cost of raw materials, the group can still sustain its margins. We understand that EBIT margin of the oleochemical division is currently RM400/tonne, which is the same as last year.

4. Specialty fats

We prefer IOI to Wilmar in this segment of the plantation value chain. After the completion of the group’s plants in USA and Malaysia, IOI would surpass Wilmar in terms of production capacity in the future.

In contrast to Wilmar’s exposure to China, IOI’s exposure is to the developed markets of USA and Europe. Although these countries are perceived as mature and stable markets, we believe that there are good growth opportunities in the specialty fats segment. We prefer the US and European markets to China for a few reasons.

First, the Chinese market is very competitive and producers compete on pricing. In comparison, the market for palm oilbased products in USA and Europe is based on palm oil’s positive health benefits. Hence, demand for palm oilbased specialty fat products is expected to be more resilient and less vulnerable to pricing.

Due to health risks associated with trans-fats, more cities in USA e.g. New York are banning the use of trans-fats in restaurants. Increasingly, food companies like Kraft are using palm oil-based products to manufacture biscuits and cookies.

Second, there are not many palm oil-based specialty fats companies in USA. Among the companies under our coverage, IOI is the only one. We reckon that IOI’s Loders Croklaan is well-placed to enjoy increasing demand for palm oil-based specialty fats products in USA.

As a reflection of improved demand and pricing, EBIT margin of IOI’s specialty fats division expanded from Euro15/tonne last year to Euro20/tonne currently. The positive outlook for palm oil in USA is also reflected in the 54% YoY surge in Malaysian palm oil exports in the first five months of the year and IOI’s expansion of its specialty-fats operations in the country.

CHART 9 : FCF/SHARE COMPARISONS (REPORTING CURRENCIES-SEN/CENTS/RPH)

COMPARISONS ON CORPORATE STRATEGY

We find that Wilmar is the most aggressive compared to the other three companies in pursuing its ambition towards becoming a global agribusiness company. The group also moves fast in executing its strategy.

By acquiring the agribusiness assets of its shareholders and PPB Group in 2006/07, Wilmar transformed not only into one of the largest vegetable oil processors in the region but also one of the biggest upstream players. Wilmar continued with its expansion plans by increasing the production capacity of its crushing and refining plants in the region and venturing into Africa and Russia.

IOI appears to be faster in executing its downstream strategy compared to upstream. In the oleochemical and specialty fats segments, the group acquired Pan Century Group last year and announced plans to build plants in US and Rotterdam this year.

However, in the upstream segment, we find that IOI is more conservative compared to the other plantation companies. The group was one of the slowest to venture into Indonesia to expand its plantation landbank.

Indofood also acted fast in the upstream segment by acquiring LonSum. This increased the group’s landbank by 40%-45%. The acquisition of LonSum ensures reliable supplies of CPO for Indofood’s cooking oil division and enhances the enlarged group’s operating margins as there is a greater proportion of upstream earnings compared to the single-digit margins that the cooking oil division currently commands.

Although Indofood is the largest cooking oil manufacturer in Indonesia, we reckon that the group is not a significant player in the downstream segment of the plantation business compared to Wilmar or IOI. It appears that Indofood prefers to concentrate on the upstream segment for now e.g. improving LonSum’s inefficient operations, reaping cost savings from the merger of assets between the two entities and venturing into sugar cane plantations.

Sime Darby is more of a conglomerate instead of an agribusiness player as it has quite a few non-plantation businesses. In the plantation segment, the group’s strategy is to reap cost-savings from its acquired companies while in the downstream segment, the group is looking to Africa and Europe for opportunities. Sime also recently announced that it would be venturing into rice production in Sarawak.

COMPARISONS ON CAPITAL MANAGEMENT POLICIES

Among the four companies, we reckon that Sime Darby would provide investors with the most attractive dividend yield. Dividend yields of the other three plantation companies are not expected to be exciting as cash is being conserved for expansion plans. Sime Darby’s FY08F dividend yield is forecast at 4% compared to IOI’s 3%, Wilmar’s 0.6% and Indofood’s 3%.

In terms of other capital management initiatives, then IOI is the most active. Since the past five years, IOI had undertaken a capital repayment exercise, a 5-into-1 share split and treasury shares cancellation.

We believe that Sime Darby has the most potential among the four companies to pay higher dividends due to the cash preference and requirements of its major shareholder, Permodalan Nasional Bhd (“PNB”). We understand that during the past five years (before the re-listing), Sime Darby’s dividend payouts had never been less than 40%.

Sime Darby’s dividend payouts are expected to be supported by rising free cash flows (“FCF”) underpinned by robust CPO prices. For FY08F, we forecast Sime’s FCF/ share at 52.1 sen versus Wilmar’s (-31.5) cents, IOI’s 11.8 sen and Indofood’s 36.6 Rph (please refer to Chart 9).

IOI is in an expansionary mode especially in the field of specialty fats. The group plans to construct a US$100m specialty fats plant in USA (200,000 tonnes/year) and a US$100m margarine plant in Rotterdam, Netherlands. In Malaysia, IOI plans to build a 150,000 tonnes/year specialty fats plant, which is expected to cost RM300m, in Pasir Gudang.

As such, we believe that IOI’s dividend payouts are not expected to be spectacular going forward. Dividend yields are forecast to range between 3% to 4% for FY08F-FY10F while dividend payout is estimated at 49% for FY08F and 44% for FY09F (please refer to Chart 10).

Unless IOI consolidates its shares back again, capital repayment is unlikely going forward as the par value of the group’s share is only 10 sen.

However, we reckon that IOI would continue to be active in buying back its shares. Since the start of the year, the group has been buying back its own shares at price levels as low as RM6.55/share.

After the amount of treasury shares reach a certain level, we believe that the group would cancel them to enhance EPS. In FY6/05, IOI cancelled 54m treasury shares and in FY6/07, the group cancelled 64m shares. As at 16 June, outstanding treasury shares amounted to 144.9m.

The same proposition goes for Wilmar and Indofood. Although Wilmar is already one of the largest agribusiness companies in the world, the group believes that it is still a growth company. The group is seeking to expand in Africa and Russia.

Wilmar’s capex is forecast at US$800m to US$1bn annually for the next few years. These would cover construction of new plants and expansion plans in Indonesia, China, Russia and Africa. We forecast Wilmar’s gross DPS at 3 cents for FY08F and 4 cents for FY09F, which translate into yields of less than 1% each (FY07: 2.6 cents).

As for Indofood, the group’s capex is in respect of plantation development expenditure and construction and relocation of refineries in Indonesia. The group’s capex is forecast at US$95m for FY08F, out of which about 53% are allocated for new plantings. Indofood’s planting programme is to cultivate 35,000 ha of land every year.

We forecast a FY08F gross DPS of 7 cents/share for Indofood, which implies a yield of 3% and payout of 13%.

COMPARISONS ON RETURN ON EQUITY(“ROE”)

1. Net profit margin

IOI’s net profit margin is 21% for FY08F versus Sime’s 10%, Wilmar’s 4% and Indofood’s 15%. Comparing IOI with Wilmar and Indofood, IOI’s higher net profit margin can be attributed to a larger proportion of upstream plantation earnings.

In comparison, Wilmar’s earnings are mainly from the single-digit margin refining and crushing businesses. Although Indofood’s EBIT margin is on par with IOI, its net profit margin is below IOI’s because of higher interest and tax expenses.

Although Sime’s earnings is mainly from the upstream plantation activities like IOI, its net profit margin is not as high as IOI due to cost inefficiencies. Sime’s FFB yield of 21.1 tonnes/ha for FY07 was lower than IOI’s 26.7 tonnes/ ha. Furthermore, Sime’s operating costs of RM960/tonne were also higher than IOI’s RM809/tonne in FY07.

Over the past two years, we find that IOI’s net profit margin improved the most between the four companies i.e. from 14% in FY06 to 21% for FY08F. Wilmar’s net profit margin inched up from 3% in FY06 to 4% in FY08F while Indofood’s remained flat at 15%. Sime’s net profit margin is also expected to be relatively stagnant at 10% in FY08F compared to FY07’s 9%.

2. Asset turnover

Asset turnover indicates how much sales are generated from the company’s assets.

We find that among the four companies, Wilmar generates the most sales out of its assets. Out of US$1.00 of asset, we forecast the group to generate revenue of US$1.52 in FY08F. This indicates that Wilmar is quite efficient in using its assets. Second in line is Sime Darby, with an asset turnover ratio of 0.9x. The asset turnover of IOI and Indofood are almost the same at 0.5x to 0.6x respectively.

We believe that factors contributing to Wilmar’s high asset turnover are the strength of its marketing and distribution network and integrated manufacturing process.

3. Leverage

Leverage indicates the proportion of debt to equity. Among the four companies, Indofood has the highest equity multiplier of 2.6x for FY08F. IOI’s and Wilmar’s leverage are almost the same at 2.3x each, estimated for FY08F. Sime’s is the lowest at an estimated 1.8x for FY08F.

Indofood’s leverage is high as the group borrowed US$180m to finance the acquisition of LonSum. However, recent quarterly results indicated that the earnings contribution from LonSum has been accretive, more than sufficient to offset the increase in interest expense.

Wilmar’s gearing is high because of the nature of its refining business. Working capital is needed to finance the feedstock needed for its palm oil and soybean crushing and refining activities and cooking oil manufacturing business. Out of Wilmar’s borrowings of US$5.0bn as at end-December 2007, about 84% were short-term borrowings. These consisted mainly of loans and discount bills.

IOI’s leverage is high because the group issued US$600m convertible bonds last year to finance its expansion plans and working capital. To recap, IOI plans to expand its specialty fats plants in Malaysia, US and Rotterdam.

Sime Darby has the lowest leverage as there are no concrete plans to build new manufacturing plants or acquire new plantation landbank yet. This is in spite of news reports back in March that the group plans to develop plantations in Africa and build new plants in eastern Europe.

Despite the high leverage of all companies, we believe that it is not a concern as palm oil is a cash-generative business. This coupled with rising CPO prices mean that the four plantation companies in this report are expected to enjoy bumper cashflows this year. Net gearing of the four companies are also envisaged to be comfortable, at a maximum level of 70% for Wilmar.

COMPARISONS ON MARKET REACH

We believe that Wilmar has the widest market reach among the four companies. In our view, Wilmar is most global player in the agribusiness compared to its peers. Although about 45%-50% of Wilmar’s pre-tax profits are derived from China, Wilmar also has a presence in faraway countries like Africa and Russia. Although earnings contribution from these two places are still insignificant, Wilmar sees these two continents as the next growth areas because of their growing population and developing economies.

To recap, Wilmar has a 50/50 joint venture with Olam International Ltd in Africa. The joint venture has investments in SIFCA, which is one of the largest agribusiness companies in the country and two of SIFCA’s palm oil subsidiaries. In Russia, Wilmar in involved in a joint venture with Nizhny Novgorod Fats and Oils Group and Delta Exports Pte Ltd.

Interestingly, IOI prefers to concentrate on developed markets instead of developing markets. Hence, IOI’s global exposure is mainly to US, Europe and Japan. Apart from higher pricing premium command by these markets, IOI’s preference for these countries is also because they are better paymasters.

Although Sime Darby has overseas operations in places like China (mainly motor division) and Africa (refining), we reckon that overseas earnings contribution is still insignificant. Although Sime did not disclose the geographical breakdown of its turnover ,we believe that most of the group’s turnover are from Malaysia and Indonesia as 70%-75% of the group’s profits are from the plantation division.

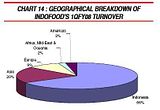

Indofood is largely domestic-centric. Almost 80%-90% of its palm oil are sold internally to the group’s cooking oil division. Indofood’s largest overseas exposure is its commodities division, which sells coconut oil in Philippines.

Based on geographical breakdown, about 55% of Wilmar’s FY07 turnover were from China and 25%, from South-East Asian countries like Malaysia and Indonesia (please refer to Chart 13). Approximately 34% of IOI’s revenue in FY07 were from Europe and 31% from Malaysia. North America accounted for 9% of IOI’s FY07 turnover (please refer to Chart 12). As for Indofood, Indonesia accounted for 66% of the group’s FY07 turnover (please refer to Chart 14).

COMPARISONS ON INTEGRATION OF THE PLANTATION BUSINESS MODEL

The most integrated among the four plantation companies is Wilmar. The group is involved in almost every segment of the value chain from upstream to downstream. Wilmar even has its own fertiliser and vessels to ship its products.

The benefits of integration is the derivation of cost savings of US$1-2/tonne from every segment of the plantation chain. For instance, having own vessels to ship products ensures timely shipments and reduces delays.

Wilmar has 19 vessels and approximately 25%-30% of its products are shipped using its own vessels. Wilmar’s fertiliser plant has production capacity of 450,000 tonnes/ year.

Wilmar has ventured further down the plantation value chain by building flour and rice milling plants in China. The flour milling plant has production capacity of 1.5m tonnes/ year while the rice milling plant’s production capacity is about 300,000 tonnes/year. Wilmar’s rationale for venturing into flour and rice is because they are still somewhat related to the group’s products. For instance, cooking oil is used to fry instant noodles, which are produced using flour.

The second most integrated plantation company is IOI. Apart from the upstream division, IOI’s operations in the refining, oleochemical and specialty fats segments are also sizeable. Currently, more than one-half of the group’s CPO are being used internally in the downstream segments.

However, apart from these three downstream segments, IOI has been quite conservative in the direction of its business. Unlike the other plantation companies, it has never ventured into biodiesel, which is good since biodiesel is currently unprofitable nor has IOI ventured into other agricultural products. Although IOI recently said that it would be building a margarine plant in Rotterdam, this is related to its existing business activities. Specialty fats products are used as inputs to make margarine.

Indofood is not as integrated as Wilmar or IOI. However, the interesting thing about Indofood is that it recently proposed to acquire a 60% equity interest for S$56m in a company, which has 37,500 ha of land allocated for sugar cane plantations. The group is venturing into the sugar business in view of the industry’s good outlook. Sugar prices are expected to remain high underpinned by demand from the food segment and ethanol producers.

The least integrated is Sime Darby. Apart from plantations, the group is also involved in businesses like motor, power and heavy equipment, which are unrelated to each other.

CONCLUSION

In summary, we find that IOI is the best in the upstream palm oil business due to its consistently high FFB yields and efficient operations. In oleochemical and specialty fats, we prefer IOI to Wilmar due to its exposure to growth opportunities offered in USA and Europe.

However, in terms of market reach, we like Wilmar. We believe that Wilmar has the potential to become a global player in the agribusiness like its shareholder, Archer Daniels Midlands. Wilmar is also the undisputed leader in the vegetable oil processing business i.e. palm oil refining and soybean crushing and refining.

Among the four companies, Sime Darby offers the most attractive dividend yield. The group’s dividend payout policy is expected to be consistently high for the benefit of its major shareholder, PNB.

Overall, we find that IOI is the most active in capital management. Over the past couple of years, IOI has undertaken a capital repayment, increase its dividend payments, carried out a share split, bought back and cancelled its shares.

Indofood is the best in cooking oil in Indonesia because of its leadership and large market share. Through LonSum, Indofood would also have access to good quality and highyielding oil palm seedlings. LonSum’s seedlings are reputed to be among the best in the world.

We maintain our Buy recommendations on the four plantation companies as each has its own strengths and field of competency. Each company also offers investors different kinds of exposure within the plantation sector. Finally, during times of uncertainties, the four companies are a safe haven with minimal earnings risk and steady cashflows underpinned by healthy CPO prices.

amresearch Plant080620.pdf

No comments:

Post a Comment