UNDERPERFORM Maintained

RM4.78

Target: RM4.60

Mkt.Cap: RM29,359m/US$8,774m

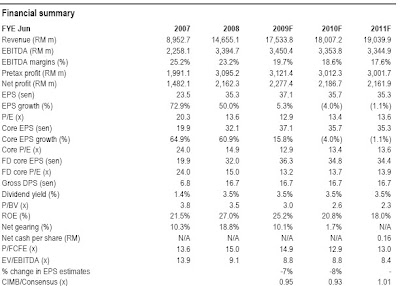

Finals below expectations. IOI Corp’s FY6/08 core earnings, excluding fair value gains on investment properties and forex gains, were 3% shy of our forecast and 10% below consensus. The earnings shortfall resulted from weaker property earnings and a higher effective tax rate. The group declared a single-tier interim dividend of 10 sen, which brings total gross dividend for the financial year to 17 sen, in line with our expectations.

Higher effective tax and weaker property earnings. The group’s effective tax rate in 4Q was 23%, higher than expected due to lower tax incentives. Its property arm, IOI Properties also missed our forecast by 20% due to lower sales and launch delays (see separate note for more details). Other key surprises in 4Q included a RM130m fair value gain on IOI Prop’s investment properties though this was partially offset by a RM92m forex loss on its US$ borrowings.

Plantation and manufacturing were the earnings drivers. 4Q core net profit jumped 85% yoy and 10% qoq, thanks mainly to better performances from the plantation and manufacturing units. Plantation EBIT benefited from a 63% rise in average CPO price to RM2,865 per tonne (RM1,759 in FY07) and a 7% increase in FFB output. Manufacturing earnings were helped by higher volumes and selling prices.

Earnings and target price downgrades. We have clipped 7-8% off our FY09-10 EPS estimates to account for our earnings downgrade of up to 24% for IOI Properties and higher tax rate assumptions. This reduces our target price by 40 sen to RM4.60, still based on a forward P/E of 13x.

Maintain UNDERPERFORM. We are keeping to our UNDERPERFORM rating in view of the heightened earnings risk from softer CPO price prospects, concern over IOI Corp’s exposure to the local and Singapore property markets and its high foreign shareholding. Key de-rating catalysts include weaker CPO price, lower property sales and higher operating costs.

No comments:

Post a Comment