August 20, 2008

PLANTATION(NEUTRAL)

Plantation stocks chalked up multiple-fold gains after we started Overweighting the sector on May 12, ‘05, but the recent sharp declines in CPO prices and plantation shares indicate that the upcycle has come to an end. Although the sector’s long-term prospects remain positive, the diminishing near term earnings visibility caused by falling CPO prices means that plantation companies’ earnings may be lacklustre on a 12-month basis. This warrants our Neutral call on the sector. However, in the immediate term CPO prices have overshot on the downside. Investors looking at a 12-month performance should lock in profits on a counter-trend rally and stay on the sidelines. However, those with a 3- to 5-year investment horizon should accumulate on weakness as a severe edible oil shortage is in the making.

OVERVIEW

We believe that so long as China’s economic growth does not falter, its edible oil consumption per capita will continue to grow at the current trajectory. This forms the basis for the single most important demand driver for edible oil. Chinese demand will require 1.9m hectares more of oil palm in 5 years’ time, or new planting of 380k hectares per year. This is substantially more than the planting rate Indonesia is capable of. On this score, we are arguing that the secular uptrend for palm oil remains intact.

In the near term, a number of factors are weighing on CPO prices, thus clouding earnings visibility on a 12-month basis. We are downgrading the Plantation Sector to Neutral although in the immediate term, we think palm oil prices have probably overshot on the downside, providing biodiesel ventures with a very comfortable margin. Demand for conversion to biodiesel will push CPO prices nearer to the biodiesel breakeven point of RM2,910/tonne. We suspect that once biodiesel producers are convinced that CPO prices are stabilising, there will be a scramble to lock in CPO price to secure the feedstock.

Investors with 12-month investment horizon should sell into strength. Re-entry should be timed towards mid-’09 when :

1. Clarity on Indonesia’s supply emerges.

2. The global economy may be on firmer footing after several quarters of slowdown. 3. The market starts focusing on 2010, whereby the underlying trend of China’s edible oil consumption growth should re-assert itself.

Longer term investors with 3 – 5 years’ investment horizon should accumulate quality stocks on weakness as the secular uptrend remains intact. A severe shortage for edible oil will materialise if China maintains its consumption trend. We also think plantation stocks will trough at a higher level this time as ROEs are significantly higher. It is also worth noting that in the previous 2 downcycles, stock prices bottomed 1 to 7 months ahead of CPO prices.

FALLING CPO PRICES CLOUD EARNINGS VISIBILITY

Inventory level remains high.Malaysia’s palm oil inventory has climbed to a record high of 2.1m tonnes, primarily due to a slowdown in exports to China. The Chinese have slowed down purchases and used their edible oil reserves to help cool inflation. We believe the reserves can only last so long before the need to replenish arises, probably after the Summer Olympics. The risk here is that if China’s economy goes into a typical post-Olympics slowdown, which is said to be common for many of the Olympics host countries, the pickup in purchases may be delayed. In the near term, with the pick-up in exports in July, inventory has fallen to slightly below 2m tonnes but still high historically. This renders CPO unable to withstand the decline in other commodities such as soybean and crude oil.

Indonesia production likely to increase in ’09. Given the aggressive planting in Indonesia since 2003 and recovery from the 2HCY06 drought, production has grown by double-digits this year and is likely to continue into ’09. Although we believe the rate of increase will slow down due to tree stress after a bumper crop this year, without a strong off-take, the high inventory levels will stay high and keep a lid on CPO prices. We believe visibility on Indonesia’s production will improve towards 1Q next year.

Pressure from other commodities. Due to the high stockpile, palm oil price has fallen to a record discount versus soybean oil at more than US$300/tonne and recently to a discount to crude oil as well. A quick look at these two commodities and their impact on CPO price:

1. Soybean/soybean oil. We had earlier expected the US Midwest flood to significantly reduce soybean production this year. Unlike the 1993 Great Mississippi Flood which happened in July after the planting season ended, the floods this time around occurred in June. Therefore, farmers still had the opportunity to replant before the mid-July window closed. We do not think US soybean crops are out of the woods yet given that the late planting would necessitate late harvesting, which exposes the crops to the risk of frost damage. This will only be known towards the October-November period. In the near term, the weather has been favourable, which creates bearish pressure on soybean. There is also the prospect of Argentinean farmers’ stand-off with the government coming to an end, which will result in a flood of soybean supply as farmers have been holding back crops due to the high export duty imposed.

2. Crude oil. The marginal cost of production for deepwater oil is expected at US$70 – 80 per barrel, which should be the absolute floor for crude oil prices. At a price below the marginal cost of production, producers will lose more with the increase in production, hence necessitating a cutback in production. Nevertheless, the psychological US$100 per barrel level may not be easy to crack. At this price level, CPO price will be at RM2,382/tonne if it trades at parity with crude oil.

Non-commercial net positions. Looking at the Commodity Futures Trading Commission (CFTC)’s weekly data on non-commercial position (speculative) on commodities, crude oil had gone from a net long of 170k contracts on combined basis in early Aug ’07 to a net long of 72k contracts. Soybean also underwent a substantially long liquidation, with the net long position of 156k contracts in Dec ’07 reduced to 62k net long positions. While we can’t say if there will be a continuous long liquidation, much of the hot air with regard to commodities has been cooled down.

Biodiesel support gave way temporarily. While we continue to believe that biodiesel will support palm oil, falling crude oil prices have pulled the carpet from under this support. Crude oil is now more expensive than palm oil, which makes biodiesel production justifiable. However, with crude oil prices falling, biodiesel buyers appear to be holding back temporarily. It is likely that once the market is convinced that crude oil has reached bottom or if palm oil inventory starts to decline, palm oil prices will quickly spring back and regain its premium against crude oil.

Risk of global economic slowdown. Partly due to high commodity prices, economies are already slowing this year with concerns of some worsening next year. Consensus estimate points to a slowdown in major economies next year with a median average of 3.5% vs. 3.7% this year. While the quantum of slowdown appears to be minimal, there are risks of a downgrade, especially with the 15-nation euro area recording just 0.2% growth for the June quarter.

As we mentioned in our May ’08 report, the squeeze in consumer spending may benefit palm oil, being the cheapest edible oil, as consumers may down trade to cheaper alternatives. In an economic slowdown, the demand for basic necessities such as edible oil will likely be substantially more resilient than that for industrial commodities. Still, lingering concerns over the global economy is likely to prevent commodities from leading the next cyclical rally.

COST PRESSURE

Cost pressure could worsen in ’09. We mentioned in our report of May 7, ’08 that the sharp increase in fertiliser cost this year will not be an issue due to: 1) high kernel prices will more than offset the rise in fertiliser price. 2) a recovery in production will mean cost per tonne of CPO will remain largely unchanged as cost is more spread out. However, with the sharp decline in CPO price and along with it palm kernel prices, the cost increase will be more significant in ’09 as the quantum of kernel credit decreases. This is assuming that fertiliser cost continues to stay high despite the decline in crude oil price. Factoring in a lower kernel price of RM1,500/tonne, we estimate that cost per tonne of CPO will increase by at least RM100, which is not an issue if CPO prices stayed at RM3,500/tonne.

Fig 5: Using POME to fertilize oil palm estates

Source: Golden Agri/OSK Research

Oil palm still has the edge. Oil palm is still more competitive than other crops such as rapeseed or soybean. Besides being the highest yielding oil crop, oil palm trees produce a lot of waste that can be used as fertilisers. Oil palm companies are also more creative with their fertiliser programmes by doing the following:

1. Bio-composting. This is done by using converting empty fruit bunches (EFB) to fertilisers with the use of bacterial catalysts. IJM Plantations is targeting to replace 5% to 10% of its fertilisers with bio-compost while Kulim Bhd believes it will reduce its chemical fertiliser requirements from 9 to 10 kg/palm/year to 6 to 7kg/palm/year. Bio-compost, however, does not have the complete nutrient content required by oil palms and will still need chemical fertilisers.

2. Palm oil mill effluents (POME). Some growers are already using POME to replace chemical fertilisers. This is practical for areas near a mill whereby POME could be pumped to small catchments between oil palm trees. We understand that POME can be used to fertilise oil palm trees without the use of chemical fertilisers and the resulting yield is higher than that using chemical fertilisers.

If chemical fertilisers become too expensive in the future, crops such soybean and corn will be rendered unprofitable long before the use of oil palm as fertiliser cost for oil palm become substantially more contained. Hence, fertiliser costs will impact on earnings but this does not make use overly concerned.

BULLISH FORCES LURKING IN THE BACKGROUND

Biodiesel economics will be back in play. Large capacities of about 15m tonnes are being built around the world. With palm oil price trading below that of crude oil, biodiesel economics will be supportive of palm oil prices. Falling crude oil prices have perhaps held biodiesel buyers back. However, our check with biodiesel players indicates that selling prices have remained at US$1,100/tonne despite falling crude oil prices. Biodiesel margins are already positive at current CPO prices. Hence, we believe that once crude oil prices stabilise, palm oil will spring back to a premium as biodiesel players would be scrambling to lock in feedstock prices. Wilmar International, the largest biodiesel player in the region with annual capacity of 1.05m tonnes, plans to increase capacity by 40% to 50%. Golden Agri Resources is also expected to make a decision soon to venture into biodiesel production. It is worth noting that Wilmar’s biodiesel capacity is being fully utilised and will remain so for the rest of the year.

Malaysia & Indonesia’s mandatory biodiesel blend. Malaysia and Indonesia are in discussions to introduce a common specification for biodiesel to be used in both countries. Should this materialise, Malaysia will burn up 0.5m tonnes of palm oil per annum as biodiesel, hence substantially reducing the inventory level. Since Malaysia has some 1.5m tonnes per annum of biodiesel producing capacity, most of which are running at very low utilization rates, the impact on palm oil requirements for biodiesel will be immediate once the blend is implemented. Malaysia will require only 0.5m tonnes of biodiesel per annum to meet B5 blend requirements and will have excess capacity of 1.0m tonnes to meet Indonesia’s requirement if the need arises. Being a net importer of crude oil (Indonesia imports about 9.8m tonnes of diesel per annum) and a net exporter of palm oil, it is only logical to use palm oil for energy purposes when it is cheaper than crude oil.

BIG PICTURE REMAINS POSITIVE

A look at supply and demand. From ’98 to ’07, the global population grew at an average 1.2%. Over the same period, the consumption of edible oil grew at 4.6%. At the rate that consumption is growing, there will be demand for an additional 7.45m tonnes of edible oil in ’09. Now with prices having corrected substantially, demand should at least grow at a steady rate.

Oil World expects palm oil production to rise by 2.8m tonnes in ‘08/’09, leaving another 4.7m tonnes to be met by other oils. The market will be hard pressed to produce enough edible oil to meet demand. Based on Oil World’s forecast, edible oil supply will only increase by 6.9m tonnes next year.

China needs more than Indonesia can supply. If one believes that Asia will be the centre of global economic growth, then income per capita will improve, which will lift edible oil consumption per capita. The good news is that most of the populous countries still consume very little edible oil. China, for example, only consumes 22.7 kg/capita compared with a developed company like Hong Kong, which uses 41.2 kg/capita. Assuming China’s economy continues to power ahead and consumption rises to 30 kg/capita in 5 years’ time, China will require an additional 9.6m tonnes of edible oil per annum. For China’s consumption to hit 30kg/capita is probable given that it grew some 5.5kg in the past 5 years. Based on an average oil yield of 5 tonnes per hectare (ha), China’s additional consumption will require an additional 1.9m ha of oil palm land, translating into new planting of 380,000 ha per year. If soybean oil is used to satisfy this demand instead, an additional 16.8m ha of soybean needs to be planted (based on soybean yield of 2.85 tonnes/ha and an oil extraction rate of 20%). This is assuming China’s population remains at 1,313m. We do not think Indonesia could manage this sort of growth given that even its largest oil palm planter, Golden Agri Resources, with its ample resources and strong balance sheet is struggling to plant 60k ha per year. Our guesstimate is that Indonesia could at best raise its oil palm hectarage by about 200k ha per year.

Fig 6: China’s edible oil consumption trend (kg per capita)

Indonesia itself will experience an increase in edible oil consumption as its middle income group doubles in the next 5 years. Its current consumption is only 21.7kg/capita and there is plenty of room for growth. Based on the same logic, Indonesia’s consumption grew by 4.5kg/capita over the last 5 years and will hit 26.2kg/capita in 5 years, and would require an additional 1.0m tonnes of edible oil, or 210,870 ha of oil palm.

Fig 7: Potential boom in demand from emerging economies

Source: Oil World

Chinese economy to slow down post-Olympics? There are concerns that China’s economy would slow down after the Olympics, which is widely believed to be the norm for Olympics host countries. With the key to steady growth in China’s edible oil consumption being continued growth of its economy, a post-Olympics slowdown could certainly dampen edible oil demand. What we found was that there is that none of the Olympics host countries slipped into a recession after the event. In some cases, such as US in 1984 and 1996 as well as South Korea in 1988, GDP growth was boosted in the year of the Olympics, after which growth normalises. Australia (the 2000 host) and Greece (2004 host) both experienced slightly lower GDP growth during the year of the Olympics.

We conclude that should the Chinese economy slow down post-Olympics slowdown, it is likely to be minimal and should not affect edible oil consumption growth. In any case, the double-digit economic growth China has been experiencing was not dependent on the Olympics in the first place.

Fig 8: GDP growth of Olympics host pre- and post-lympics

What can happen in a severe shortage. If the scenario above unfolds, we are looking at an acute shortage of edible oil in the not-too-distant future. We imagine that oil palm plantation companies will trade at substantially higher valuations due to:

1. An increase in global dependence on palm oil. This will inevitably happen as oil palm has by far the highest oil yield.

2. Stability of supply. Given oil palm’s perennial nature, supply is significantly more predictable than annual crops, which are much more susceptible to adverse weather. Global warming will cause the weather to be more unpredictable.

Against this bullish long-term backdrop, we believe investors with investment horizons of 3 – 5 years should accumulate plantation stocks on any price weakness.

Fig 9: Increasing global dependency on palm oil (Source: Oil World)

CPO PRICE ASSUMPTION

Lowering CPO price assumptions for ’08 and ‘09. Given the weaker-than-expected palm oil prices, we are forced to tone down our price assumptions for CY08 and CY09. We are lowering our CY08 assumption to RM3,150/tonne from RM3,500 previously. Up to the week ending Aug 15, ’08 CPO prices have averaged RM3,452/tonne (US$1,071/tonne). Assuming that prices hover around RM2,500 for the rest of the year, we will exit the year with an average of RM3,150.

Given the poor visibility for CY09 at this point in time, we are factoring in a lower CPO price assumption of RM2,800/tonne, which is below the RM2,910/tonne we estimate to be the breakeven price for biodiesel. We do see some light at the end of the tunnel in that equity markets, particularly the US market, are starting to gain traction from the broad decline in commodity prices. If lower commodity prices lead to easing inflation to the extent that consumer spending starts to increase once again, commodities will eventually get back into an upcycle.

Bullish forecast for CY10. We are pricing in a stronger CPO price assumption of RM3,300/tonne for CY10. We are also assuming that the long-term uptrend in China’s in edible oil consumption per capita will re-assert itself by then. Investors with an investment horizon of 12 months should be ready to “load the boat” towards mid-09, during which we believe the earnings visibility of plantation companies will improve.

DOWNGRADING SECTOR TO NEUTRAL

With deteriorating earnings visibility on a 12-month basis due to falling CPO prices, we are downgrading the sector to NEUTRAL from OVERWEIGHT previously. We are also downgrading stock calls from BUY across the board previously to TRADING BUY across the board, lowering our target prices 5.8% to 51.1% as per the table below. We have not downgraded individual stock calls to Neutral or Sell as we believe CPO prices as well as stock prices are grossly oversold and could stage a counter-trend rally. A rebound will provide an opportunity for investors to exit at better prices.

Although CPO price is currently in a cyclical downtrend, we maintain that investors with a longer investment horizon of 3 – 5 years should accumulate on price weakness as we believe the secular uptrend remains intact. Investors with a one-year investment horizon should look to buy towards mid-09, during which we believe companies’ earnings visibility will improve given the long term uptrend in China’s edible oil consumption.

CHANGE IN EARNINGS FORECAST

Fig 10: Revised forecast and new target prices

ADJUSTING STOCK TARGET PE MULTIPLES

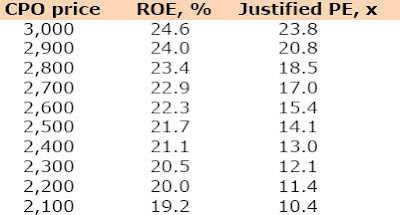

Higher ROE => Higher PE. We believe plantation stocks will trough at higher PE multiples than during the last downcycle, simply due to stronger ROEs with CPO prices at current levels. Despite the cost pressures, ROEs will still be higher than they were in previous troughs during which CPO prices were at below RM1,500/tonne.

Historical numbers show us that trough PE tends to move in tandem with ROE. This can also be explained using a justified price/earnings formula (dividend payout/(ke – g), whereby growth is retained earnings multiplied by ROE, pointing to higher trough valuations. As such, we suspect IOI Corp may not revisit the 12x PE it fetched in the 2004/2005 downcycle.

Even when we price in CPO price of just RM2,600/tonne, IOI Corp can still generate an ROE of 24%, partly due to its strong downstream activities. Factoring in a 24% ROE, a risk-free rate of 4.77%, a risk premium of 8.2%, beta of 1.17 and a dividend payout of 50%, IOI’s justified PE stands at 20.8x.

To justify IOI at its FY04 trough PE of 10.4x, ROE needs to fall back to 19.2%, and that would necessitate CPO prices falling to RM2,100/tonne. Hence, if we assume the recent CPO price low of RM2,513/tonne as the average CPO price, IOI Corp will generate an ROE of 21.8%, justifying a PE multiple of 14.3x, which is still higher than its FY04 trough earnings multiple. Similarly, Asiatic is unlikely to fall to its ‘05 trough PE of 7x.

Fig 12: Justifying IOI Corp’s trough PE

No comments:

Post a Comment