2008-08-19 19:05

(吉隆坡)IOI集團(IOICORP,1961,主板種植組)2008財政年業績低於預期10%,主要是產業領域表現遜色。在原棕油價回軟與營運成本提高下,分析員對未來前景從樂觀情緒轉為謹慎,國內外證券行甚至紛紛下調目標價與評級。

儘管業績表現不錯,但受到市場不看好聲浪影響,IOI集團今日(週二,19日)股價先揚後挫,開盤揚升4仙至4令吉82仙,但稍後有沽售壓力出現,一度走低6仙至4令72仙,閉市掛4令吉74仙,跌4仙。

分析員認為,雖然原棕油價格今年為止已滑落21%,導致此股跟隨下調38%,但短期內在缺乏新鮮指引料會繼續低迷。不過料下調風險獲支撐,主要是積極的回購股票策略。

耗資11億回購股票

IOI集團在2008財政年共耗資11億令吉回購1億5180萬股股票。

IOI集團第四季核心淨利按年激長85%至5億5170萬令吉,主要是包括一筆投資產業的合理價賺益達1億3000萬令吉,抵銷美元借貸的9200萬令吉外匯虧損,協助推高全年淨利按年增漲51%至22億3200萬令吉。

除了產業領域外,其他領域都取得大幅增長。在種植業與製造業表現傑出下,令整體營運盈利按年增長54%至31億7200萬令吉。不過,產業發展與製造業賺幅縮窄,令營運盈利賺幅下滑1.4%至21.6%。

目前種植股與製造業仍是盈利收入來源,其中受到原棕油平均價高企2865令吉及油棕鮮果串產量提高7%刺激,全年種植營運盈利按年揚升96%至18億3600萬令吉;製造業盈利則是在偏高銷量與售價帶動下,按年攀高62%至6億5800萬令吉。

IOI產業盈利跌3.6%

不過,其產業臂膀IOI產業(IOIPROP,1635,主板產業組)核心盈利按年下滑3.6%至3億9390萬令吉,主要是偏高建築成本與銷售組合轉換,加上銷售額偏低與部份產業延遲推介;偏低的稅務津貼導致第四季有效稅率達23%,這也是拖累盈利下滑主因。

至於種植營運成本每公噸也揚升100令吉至906令吉,主要是偏高肥料成本,由於今年肥料成本按年已增長30%至每公頃1900令吉,分析員對種植業前景轉淡。

IOI集團調低8%

IOI產業下修24%

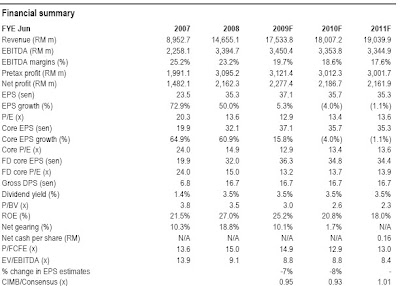

聯昌研究指出,在原棕油價格走軟及偏高稅務預測等顧慮下,加上顧慮馬新產業計劃發展而下調IOI產業盈利達24%下,因此下調2009至2010財政年每股盈利7至8%。下調催化劑包括原棕油價持續下滑、偏低產業銷售與偏高營運成本。

明年棕油價預測2850令吉

亞歐美研究也因為偏高肥料成本而下調2009至2010財政年盈利1.4%至1.9%。雖然原棕油在下半年開始走軟,不過仍維持2009至2010財政年原棕油價預測各為每公噸2850令吉與2500令吉。

達證券則認為,此公司2009財政年首3個月原棕油期貨已以每公噸3500令吉出售,由於首季銷售量佔全年30%,因此在原棕油價格下調前成功以高價脫售,料現財政年平均原棕油價格仍可維持在每公噸3400令吉。

同時,分析員認為與森那美(SIME,4197,主板貿服組)與吉隆坡甲洞(KLK,2445,主板種植組)比較,IOI集團是3大種植股中最不受原棕油價格波動影響的大資本股,主要是有許多下游事業分散風險。

至於IOI集團宣佈派發終期股息10仙,令全年總股息為17仙,週息率為3.6%,符合市場預期。亞歐美表示,雖然派息率僅有35%,主要是耗資回購股票政策影響,不過仍看好未來3年派息率可回升至50%。

星洲日報/財經‧2008.08.19

27-08-2008: Analysts: Small impact from Menara Citibank buy on IOI earnings

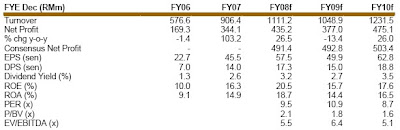

IOI Corp Bhd’s acquisition of Menara Citibank for an undisclosed price is expected to have a small impact on its bottom line, analysts said.

“With no details especially on pricing, it is difficult to evaluate the financial impact of the acquisition with a high level of certainty. Nonetheless, the anticipated incremental contribution to IOI Corp is likely to be small, given the net property yield anticipated… is unlikely to be above 6% given the tight Grade A office supply presently,” Aseambankers Research said.

In its announcement on Monday evening, IOI Corp confirmed news reports that it had succeeded in its bid for the building but said details would only be given “as soon as the definitive agreement has been executed”. However, IOI Corp did say that the RM800 million price mentioned in news reports “is purely speculative”.

Aseambankers Research said IOI Corp shares “could underperform other large cap pure plantation plays as the acquisition may have the undesired effect of further diversification into property, unless there is a strategic reason”.

CIMB Research, for one, told clients that it was “slightly negative on the deal”, pending details on pricing. “(The purchase) appears to be a diversification away from the group’s main core activities of plantation and resource-based manufacturing. Presently, most of the group’s investment properties are held by its property arm, IOI Prop and the investment properties that IOI Corp holds are mostly built by the group at its own property projects,” CIMB Research said in its daily note.

Aseambankers Research said the net yield for the purchase “should not be greater than 2%”, after taking into account interest expenses and taxes. It maintained its fully valued recommendation on IOI Corp and its RM4.70 target price, based on 15 times FY2010 earnings.

“At a capital value of RM800 million or RM1,055 per sq ft, which IOI Corp is refuting, we estimate that the net income impact is RM16 million, small relative to its net profit of at least RM2 billion,” it added.

Nonetheless, it also told clients the purchase raises several questions, taking note that IOI Properties Bhd was not suspended when IOI Corp released its statement yesterday. (IOI Corp shares were suspended at 4.22pm on Monday.)

“Will IOI Corp subsequently inject Menara Citibank into IOI Prop Bhd? Is IOI Corp taking IOI Prop private? Is (this prelude to the creation of) a future REIT?” Aseambankers Research wrote.

The research house reckoned IOI Corp is “unlikely” to inject Menara Citibank into IOI Prop, citing a failed attempt by the company to inject IOI Square and Putrajaya Marriott Hotel into IOI Prop in 2004. However, there may be other reasons for the move.

“More interestingly, we think IOI Corp’s participation in property investment, instead of streamlining its property and plantations businesses, suggest that IOI Corp could take IOI Prop private over time,” Aseambankers said.

IOI Corp controls 77% of IOI Prop, following a rights issue and the latter is trading at 1.24 times book value of RM3.63, it said.

Aseambankers Research said IOI Corp’s purchase could be “for strategic reasons”, including the potential of creating a REIT (real estate investment trust) to unlock value for IOI Corp’s existing properties by leveraging on Menara Citibank’s appeal.

“It is rather rare for a developer to buy an investment property, unless it is for redevelopment purposes. This is also puzzling, since IOI Corp can build cheaper office buildings and make good development margins.

Meanwhile, based on the speculated price, RHB Research estimated that rental yield for Menara Citibank was about 3.5%.

However, it pointed out that the building, if majority owner-occupied, may be partly the reason yield is significantly below average. The vendor — Inverfin Sdn Bhd — is controlled by Menara Citi Holdings Company Sdn Bhd (50%), Singapore-based CapitaLand Ltd (30%) and Amsteel Sdn Bhd (20%).

“It is understood that Citigroup will retain its Malaysian branch offices at Menara Citibank and will lease the space from the new owner,” RHB Research said in its note.

RHB maintained its forecasts, market perform recommendation and sum-of-part valuation of RM5 per share for IOI Corp pending details. Based on the speculated price and assuming IOI Corp funds the entire purchase using debt, RHB Research said the acquisition would have “an insignificant negative impact of less than 1%” to earnings. However, net gearing would rise to an estimated 32% in FY09 from its current estimate of 25%.

Meanwhile, Affin Research said it reserved its view on the purchase pending details. However, it does not expect the IOI Corp management to overpay, adding that funding “should not be an issue” given its cash reserves of almost RM3 billion as at end-June and the profitability of its plantations business. Affin Research has a buy on IOI Corp, with RM7.55 target price, significantly higher than Aseambankers’ and RHB’s target for the stock.

IOI Corp fell 18 sen to RM4.82 yesterday with 12.59 million shares changing hands.