TRADING BUY Maintain

Price RM5.45

alvin.tai@osk.com.my

Target RM6.45

Still A Good Quarter

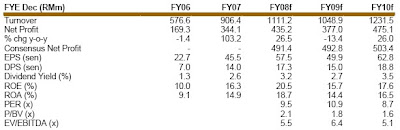

Asiatic set another record with its quarterly earnings coming in at RM115m on the back of strong CPO prices. However, 3Q earnings could be substantially weaker with CPO prices at RM3,000/tonne. We think consensus expectation has not been toned down sufficiently to realise the prevailing weaker CPO prices. We have priced in an average CPO price of RM2,800/tonne for CY09, which places Asiatic at an inexpensive 11x earnings. Although the next few quarters will be rough, we believe CPO prices may have overshot on the downside. We have recently downgraded our call for Asiatic to Trading Buy from Buy with a Neutral call on the sector.

Results in line. On an annualised basis, Asiatic’s 1H results were 5.4% above our recently lowered profit forecast of RM435.2m but were 6.7% below consensus. We expect a weaker 2H as the decline in CPO prices will not be sufficiently compensated by the seasonally stronger production. Q-o-q results were flattish despite the 17.9% rise in turnover, due to the weaker property and non-segment performance. Looking at the plantation segment alone, both revenue and PBT rose by 15%. Asiatic sold but has not delivered 4k tonnes of palm oil at end-1Q, which helped to boost 2Q numbers. If we were to attribute the 4k tonnes to 1Q, net earnings would have dropped by around 14% sequentially.

Realised CPO near MPOB average. Asiatic’s realised CPO price of RM3,534/tonne for 2Q and RM3,473/tonne for 1H compared with MPOB West Malaysia prices of RM3,520 and RM3,472 respectively. The better 2Q average selling price was likely due to the 4k tonnes yet to be delivered as mentioned above.

Production numbers up 7.5% YTD. Asiatic’s FFB production grew 7.5% y-o-y up to July. Management thinks 1H:2H production ratio will probably be in the region of 47:53, which means full year production will be at 1.167m tonnes against our forecast of 1.290m tonnes. We are not overly concerned over any shortfall as production momentum is still strong going into the peak month of September.

Raises dividend again. The company has declared an interim dividend of 5 sen compared with 3.25 sen last year. Asiatic now sits on a comfortable cash pile of RM618m to be used for funding its Indonesia expansion.

No comments:

Post a Comment